It is a fact that an unbelievable number of our CPF investments are underwater. I am doubtful GIC is a shrewd fund manager.

The PAP has not been able to convince thinking Singaporeans that our CPF scheme is not a scam. To do so would require GIC to disclose all its investments and I suspect many will prove to be deeply embarrassing.

Singaporeans who are still unconvinced can analyse the 281 investments on this list. It’s of course not a complete list but if there’s any evidence of GIC’s superior performance, please share the information. I have already posted some wiped-out CPF investments and will continue to do so as objectively as our mainstream media.

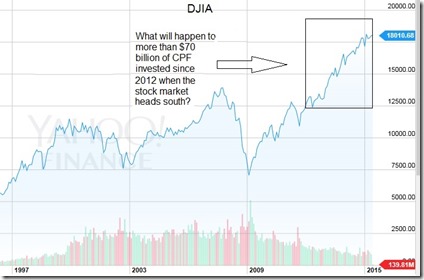

Investments exceeding $1 billion will soon become the norm due to the legislated retention of humongous amounts of our CPF, ie the total amount of CPF balances doubled from $136 billion to $275 billion during the last 7 years. GIC is aware of the “inflated prices across all asset classes” but is forced to invest (risk) about S$20 billion of CPF monies annually. It is a fact that economic ‘growth’ post Global Financial Crisis has been built on a mountain of debt.

Source: Yahoo Finance

Most stock market indices, such as Germany’s DAX, have been hitting new highs since 2 years ago. Perhaps our multi-million dollar GIC directors do not believe that stock markets are cyclical in nature?

Source: Yahoo Finance

GIC is not a nimble investor and frequently goes in for the kill. It is a major shareholder in many foreign companies, with stakes of more than 5%. When a financial crisis hits, GIC will not be able to exit when stock prices are plunging due to a lack of liquidity. In a prolonged economic downturn, divestment by a major shareholder like GIC will result in gargantuan losses.

A recent example is its 63% investment in Nirlon. GIC’s Plan B = wipeout.

Unaccountability THE problem with GIC (PAP)

The 2 biggest investment blunders in GIC’s history are UBS and Citigroup. No one has been held accountable as if the combined 7-year S$25 billion investment is loose change.

Lee Kuan Yew justified GIC’s bad investments by merely stating “..we went in too early. This is the part of the ride”.

Lee was actually taking us for a ride because GIC was not investing in solid businesses but speculating for capital gains. Solid businesses make profits, declare regular dividends and the share price naturally heads north.

UBS AG long-term chart

Source: ft.com

Citigroup long-term chart (divide share price by 10 due to reverse stock split in 2011)

What’s so good about investing in a company whose share price has dropped 90% from 9 years ago?

GIC did make some money from its Citigroup investment but this has nothing to do with good judgement as many have come to believe. It was entirely based on luck. As confirmed by its current share price, Citigroup was horribly mismanaged, ie it had taken on excessive risks with the possibility of bankruptcy.

GIC had invested in Citigroup notes with a 7% coupon payment at a conversion price of $26.35. To prevent its bankruptcy, the US government bailed out Citigroup and the original conversion price wasreduced to $3.25. Without the reduction, GIC would be sitting on massive unrealised losses of more than 60%.

The point to note is GIC had not expected Citigroup to be:

– a candidate for bankruptcy

– its ‘attractive’ conversion price of $26.35 to be reduced by 87% to $3.25

– US taxpayers to bail out its investment.

Is this then not some sort of ‘tikam-tikam’ investment? Should anyone have faith in a fund manager who makes money by hoping for the best?

GIC has invested about S$25 billion in Citi and UBS whose net return is close to zero after 7 years. Can GIC’s smaller investments be expected to perform well when it has proven to make lousy judgements on much bigger investments?

The GIC board may not be involved in the day to day investment decisions but they certainly had beenconsulted before $25,000,000,000 of our CPF and reserves were invested. By not holding any director accountable, it appears the government has condoned risky behavior. GIC has therefore not learnt any lesson form its mistakes and CPF members should expect more losses when the next financial crisis hits.

GIC’s returns cannot be confirmed

The payment of CPF interests does not confirm GIC has been able to earn a 20-year 4.1% annualised real rate of return. Without providing a proper set of accounts, no CPF member should believe GIC’s data blindly. The payment of CPF interests was likely to have been from our reserves.

Government absorbed ‘losses’ 8 out of 20 years?

Last year, DPM Tharman told parliament that “in eight out of 20 years, GIC’s returns were lower than the rate promised to CPF members, but the Government absorbed the losses”. Why then were our reserves used 8 times without Parliament or the President being informed?

To claim that “the Government absorbed the losses” is at best a half truth because CPF member are also taxpayers. Assuming a CPF interest rate of 4% with GIC’s rate of return at 2%, we have:

GIC (2%) + Govt (2%) = CPF (4%, also taxpayers)

GIC (2%) + Taxpayers (2%) = CPF (4%, also taxpayers)

The government is not a separate entity and is funded by taxpayers. All CPF members are taxpayers and we are effectively paying ourselves. There are no losses by the government.

Singaporeans are being forced to pay for an underperforming GIC, our ‘professional’ fund manager. In a true democracy, GIC would have been history.

Understanding NIR framework confirms my suspicions

The PAP has tried to confuse the public by introducing complicated schemes and frameworks. Few would then bother to question the government or understand its motives. But it is not really that difficult to understand when we focus on key words.

The PAP currently supplements our budget with (1) up to 50% of the long-term expected real returns on the (2) relevant assets under the Net Investment Returns framework:

(1) PAP wants the public to keep guessing its “up to 50%”, which could mean anything from 1% to 49%. “Long term” could mean 10-year or 20-year which again PAP is not being upfront. Words which are meaningless to the public confirm PAP’s intent to conceal information.

PAP wants to prevent public knowledge of our reserves, money which belongs to citizens but somehow we aren’t supposed to know.

Bear in mind this is not income earned from investments but expected future earnings. In a bad year where investment income is insufficient, PAP will be able to spend money which has not been earned, ie from our reserves. Neither does it need to inform the president nor consult Parliament. Read post by andyxianwong with links to other blogs.

(2) Relevant assets are defined under the Constitution as the “assets managed by GIC and MAS, minus the liabilities of the Government (which include SGS and SSGS) and MAS. In short:

MAS + GIC assets – (SGS + CPF) = Relevant assets

The ability to determine the returns on relevant assets means the PAP (MAS?) must have known the actual investment returns earned by SGS and SSGS (CPF).

Conclusion

It is not possible that PAP does not know the actual CPF investment returns. When the government uses the excess return above the CPF rate to fund government expenditures, money which rightly belongs to me, I feel I have been cheated.

In order to avoid disclosing actual CPF investment returns, the PAP has created a smokescreen of half-truths.

The non disclosure of material information on CPF and the unaccountability of GIC have made it impossible for me to trust GIC (PAP) with my CPF. Do you?

Philip Ang

Source: https://likedatosocanmeh.wordpress.com