In one of the most expensive countries in the world to own a car, Peter Chiu is finding a novel way to pay for one.

The 58-year-old retired policeman rents a car in Singapore, drives three to four hours a day for Uber Technologies Inc. to cover its cost, and has a shiny Honda Vezel the rest of the time for his personal use. Hiring a vehicle to work for Uber is becoming a more common sight in the city-state, where Chiu’s SUV costs more than a BMW M3 luxury sports sedan does in New York.

“Buying a car in Singapore is so expensive,” said Chiu. “If you want to drive around to cover expenses, that is quite easy. And any extra money you get, that’s more income for you.”

New technologies are not only disrupting traditional industries in Singapore — a trend that Prime Minister Lee Hsien Loong said will force the economy to transform — but also changing consumers’ behavior as they try to cope with rising costs and unemployment at a six-year high.

“Uber is another avenue for employment,” said Brian Tan, an economist with Nomura Holdings Inc. in Singapore. “It makes the labor market more efficient, because it provides you with an alternative career. You don’t need a special license for that.”

A Honda Vezel like Chiu’s typically sells for more than S$100,000 ($71,000) in Singapore, almost four times the price in the U.S. On top of taxes, car owners in the city state are forced to buy permits — called Certificates of Entitlement — which are limited in supply and auctioned by the government to help curb road congestion and pollution. At the most recent offering this week, the permit cost S$50,789 for the smallest vehicles.

Rental Surge

Chiu drives six days a week for Uber, just enough to cover the S$500 weekly cost of his vehicle, which he rents from Lion City Rentals, a local subsidiary of the car-hailing company. He doesn’t mind the part-time work or the traffic in a country that’s smaller than Rhode Island in the U.S.

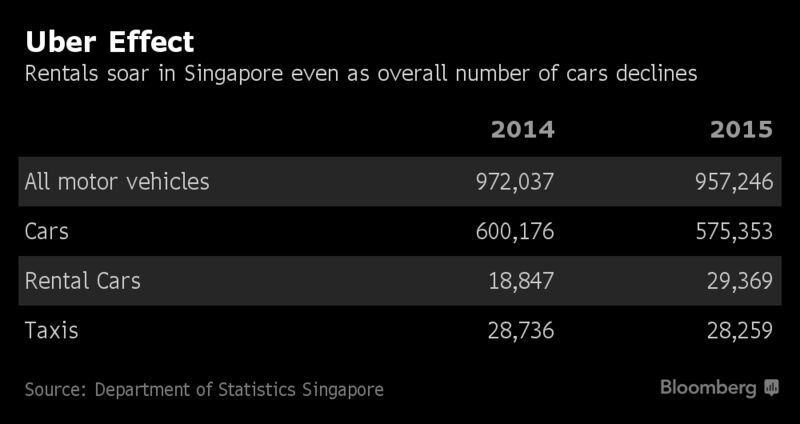

Between 2014 — the year after Uber began operating in Singapore — and 2015, the number of rental cars in the country soared more than 50 percent to 29,369, surpassing the number of taxis on the road, according to official data. Even so, the total vehicle population decreased by 1.5 percent.

Simon, a 45-year-old former property agent who preferred to give his first name only, rents a Toyota Corolla and drives for Uber four hours a day at most. A slump in home sales since the government began imposing measures to rein in prices has pushed many in the industry to seek other sources of income, including ferrying commuters around the island for Uber.

Simon said his main job now is making “alternative investments” and the Uber gig allows him to have a car of his own to use on weekends, when he makes trips about 20 kilometers (12 miles) across the border to Malaysia with his wife and two kids. The journey has an added cost-saving advantage: he buys gas for his car in Malaysia, where it’s cheaper.

Uber is using auto rentals and financing to attract and retain drivers around the world, as are rivals such as GrabTaxi Holdings Pte in Singapore and Lyft Inc. in the U.S. While for many drivers, earning an income may be the main reason they turn to the ride-hailing companies, in Singapore, having the car may be just as important.

“It makes a lot of sense to rent a car,” said Tang Kin Yee, 53, whose main job is in commercial photography and advertising. Business was slow last year and he started driving for Uber to supplement his income.

He now rents a Honda Vezel and is thinking about driving for Uber full time.

Source: www.bloomberg.com